Shape Your Year, Master Your Money, Secure Your Future

Simplify budgeting, control spending, and achieve success every Year

Budget Your Year, Own Your Future

“Take charge of 12 months, all year long.”Plan your financial journey across 12 months. Our yearly budget planner gives you a clear roadmap to manage money, stay disciplined, and reach long-term goals.

Set Annual Goals That Inspire

“Dream big, achieve bigger.”Break down your financial ambitions into yearly targets. From saving to spending wisely, every decision is guided by a clear, big-picture plan.

Track Your Progress Year by Year

“See how each year contributes to your success.”Monitor trends and spending across the year. Annual tracking helps you spot patterns, adjust strategies, and optimize your finances continuously.

Build Habits That Last All Year

“Consistency compounds over time.”Yearly planning encourages sustainable routines. By reviewing finances across years, you create habits that drive long-term control and growth.

Spot Opportunities to Grow Your Wealth

“Identify savings and investment chances before they pass.”Yearly insights highlight areas to maximize savings and increase financial efficiency. With a full-year view, you can act strategically, not reactively.

Celebrate Your Annual Milestones

“Every achievement fuels your motivation.”Recognize progress at year-end and throughout the years. Celebrating wins keeps you inspired and reinforces strong financial behaviors.

Plan for Life’s Surprises

“Confidence comes from preparation.”Our yearly budget planner helps you foresee expenses and unexpected events, so your finances stay protected and your goals stay on track all year long.

Reflect, Learn, and Set Next Year’s Goals

“Finish strong, start stronger.”At year-end, review successes and lessons. Reflection transforms insights into action, helping you start the next year with clarity and confidence.

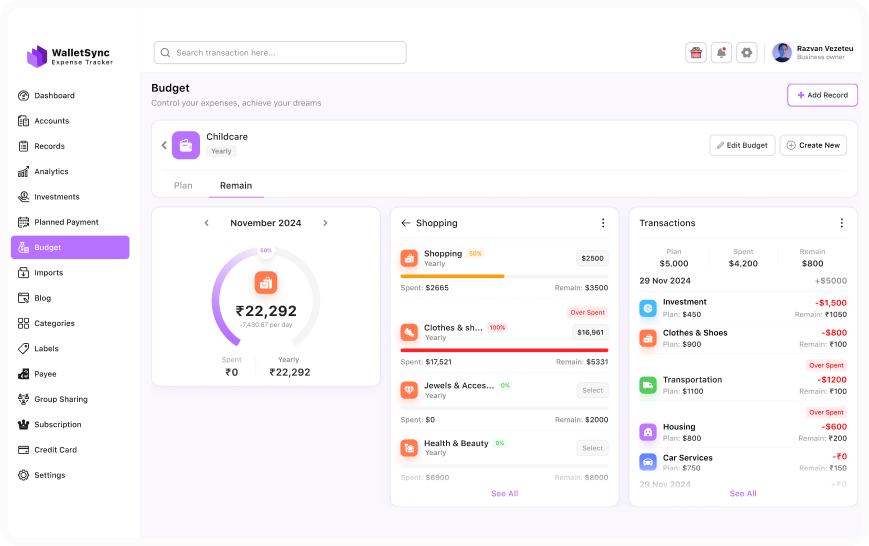

See How WalletSync Makes Yearly Budgeting Easy

Creating a yearly budget is simple with WalletSync. Watch this quick video to see how you can set goals, track your progress, and stay in control of your money all yearr long.

FAQ

Explore our FAQ section to discover detailed answers to the most frequently asked questions.

Take Control of Your Year Today

Start managing your finances with confidence and clarity. The WalletSync yearly budget planner makes it easy to set annual budgets, track spending across all 12 months, and achieve your big-picture financial goals. Make this year your most financially organized and successful yet.

Get Started Free

Get Started Free