Plan Your Month, Grow Your Savings, Reach Your Dreams

Simplify budgeting, control spending, and achieve success every Month

Master Your Month from Day One

“Set the stage for financial success.”Start each month with a clear plan and purpose. Our monthly budget planner helps you allocate your money wisely, so you can take control from the very first day and make the most of every dollar.

Plan, Track, and Adjust Your Spending

“Stay flexible and in control.”Map out your monthly expenses, monitor your progress, and tweak your budget as needed. Using the monthly budget planner, being proactive lets you avoid surprises and keep your finances on track.

Spot Trends Before They Happen

“See the patterns, make smarter choices.”Gain insight into where your money goes each month. Recognize spending habits early and make informed decisions that keep your goals within reach.

Optimize Your Monthly Goals

“Turn plans into measurable results.”Set actionable objectives for every category and track your progress. Monthly planning gives you a roadmap to hit targets, save more, and grow your financial confidence.

Build Monthly Habits That Stick

“Small changes now, big impact later.”Consistent monthly budgeting creates routines that stick. Over time, these habits lead to better control, smarter choices, and lasting financial freedom.

Celebrate Monthly Wins

“Every achievement fuels motivation.”Acknowledge your successes, no matter how small. Recognizing milestones keeps you inspired and reinforces the behaviors that make your finances stronger.

Build Momentum Every Month

“Keep more of what you earn.”Small, consistent monthly steps lead to big, long-term results. The monthly planner helps you maintain control and grow your savings over time.

Reflect and Prepare for the Next Month

“Learn from your month and get ahead.”Look back at your spending, adjust strategies, and plan for the month ahead. Reflection turns insights into action, setting you up for even greater success.

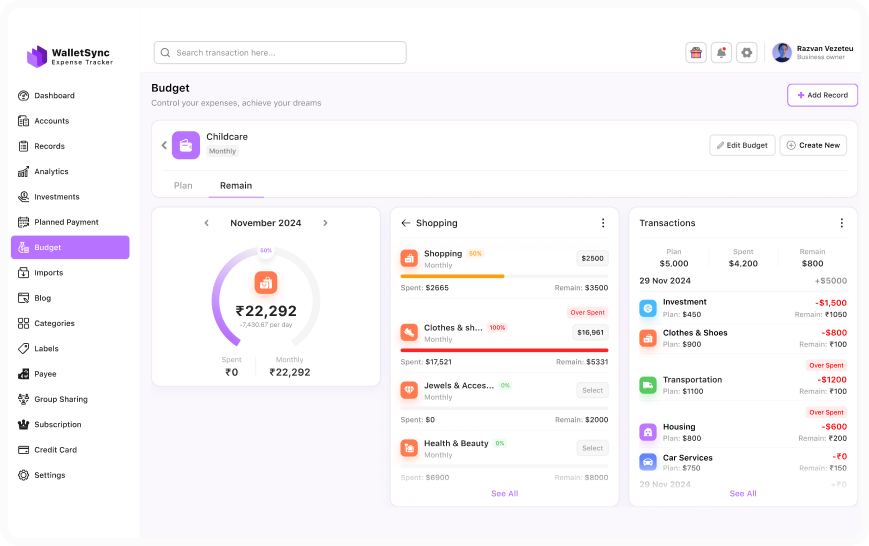

See How WalletSync Makes Monthly Budgeting Easy

Creating a monthly budget is simple with WalletSync. Watch this quick video to see how you can set spending limits, track your expenses, and stay in control of your money every month.

FAQ

Explore our FAQ section to discover detailed answers to the most frequently asked questions.

Take Control of Your Month Today

Start managing your money with confidence and clarity. The WalletSync monthly budget planner makes it easy to set monthly budgets, track spending, and plan ahead. Turn each 30-day cycle into progress and take charge of your finances now.

Get Started Free

Get Started Free