Budget Calculator

If you have never created a budget before or it has been a while, this WalletSync budget calculator gives you a clear starting point. Just enter your income, and you will see a clear outline of how to organize your spending across essential costs, lifestyle choices, and long-term savings. It provides a balanced structure that is simple to follow and easy to adjust.

50/30/20 Budget Calculator

Enter your after-tax income. The budget calculator will automatically divide your income into Needs (essential costs), Wants (lifestyle spending), and Savings using the 50/30/20 budgeting approach to help you manage your spending smarter.

Income

Expenses

Budget Visualization

Needs 50%

$0.00

Wants 30%

$0.00

Savings 20%

$0.00

This budget calculator helps you understand how to balance your income across everyday expenses, enjoyable spending, and financial growth. By entering your income and viewing the breakdown, you can see how to cover what matters while still planning for the future.

It gives you a structured starting point that removes the stress of guessing. Instead of wondering where your money goes each month, you receive a clear budget outline that is easy to adjust to your lifestyle and goals.

You can use this online budget calculator anytime, whether your income changes or your financial plans evolve. It is simple, flexible, and designed to help you feel confident and in control of your monthly spending.

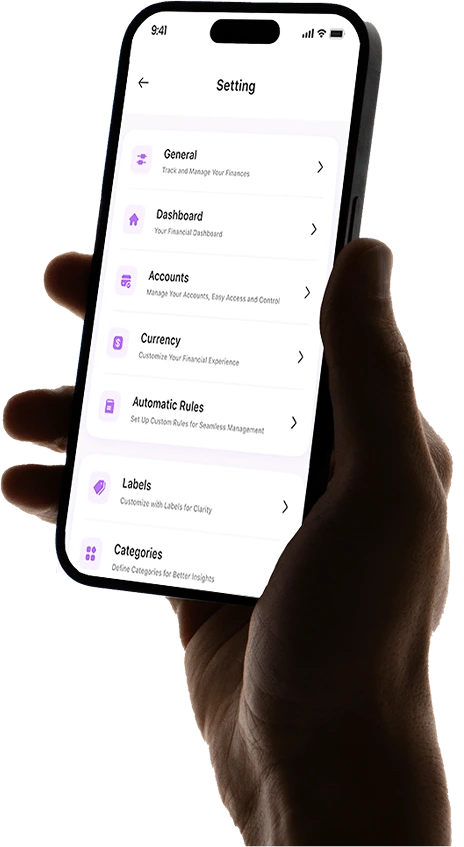

Take Control Beyond the Calculator

This calculator provides a helpful overview. But real control happens when you track your spending daily.

The WalletSync app helps you maintain that consistency by allowing you to:

- Track your income and expenses in real time

- Set spending limits that fit your lifestyle

- Monitor savings progress

- Receive helpful reminders and insights

If you want budgeting to become easier and more reliable, WalletSync supports you every step of the way.

So don't wait. Download WalletSync and start your budgeting journey today!

FAQ

Explore our FAQ section to discover detailed answers to the most frequently asked questions.